Tomasz Konobrodzki

Product Owner in the myRaiffeisen project

Know Your Experience.

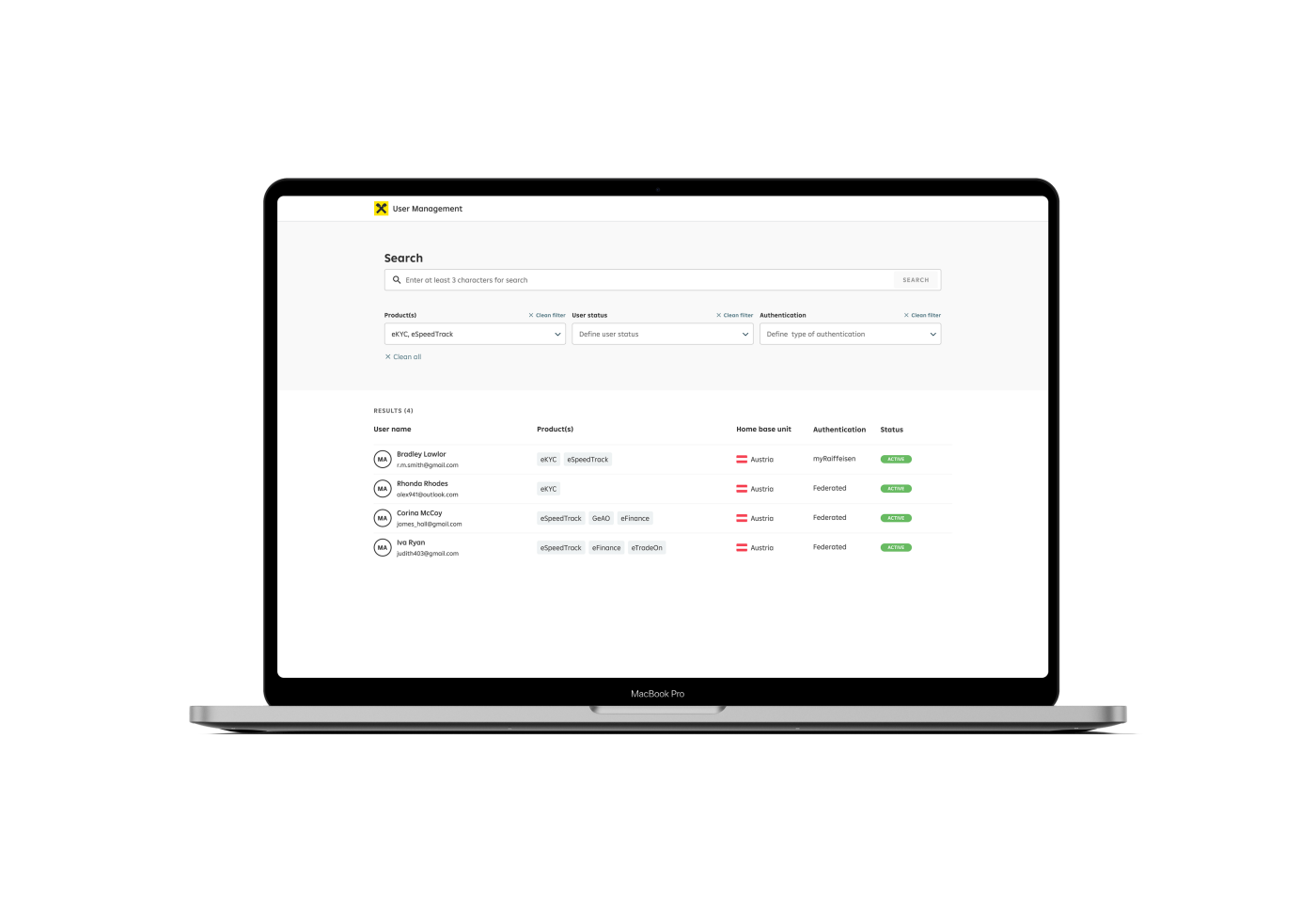

The myRaiffeisen.com platform is a comprehensive digital environment that enables corporates and institutions to carry out key financial processes entirely online. It offers access to modern applications supporting remote document signing, customer identification, account opening, payment management, trade and export financing, and market analysis – all in one place, without the need for physical presence.

Today, the main goal of the products created by the myRaiffeisen tribe teams is to improve customer experience and streamline business processes.

The platform was created in 2019, initially consisting of two teams in Vienna. In 2020, the Eagle team was established in Poland, creating solutions for institutional clients on the platform. Later, another team was formed in Vienna. For five years, the platform was developed by two tribes. At the beginning of 2025, they were merged into one to work together in international teams on the development and maintenance of the platform.

The myRaiffeisen.com platform aims to facilitate the daily operations of institutional and corporate clients by offering digital, seamless, and secure solutions for all banking needs.

Listening to our customers and analyzing the competition's digitalization efforts, we strive to deliver innovative solutions.

Created by our teams:

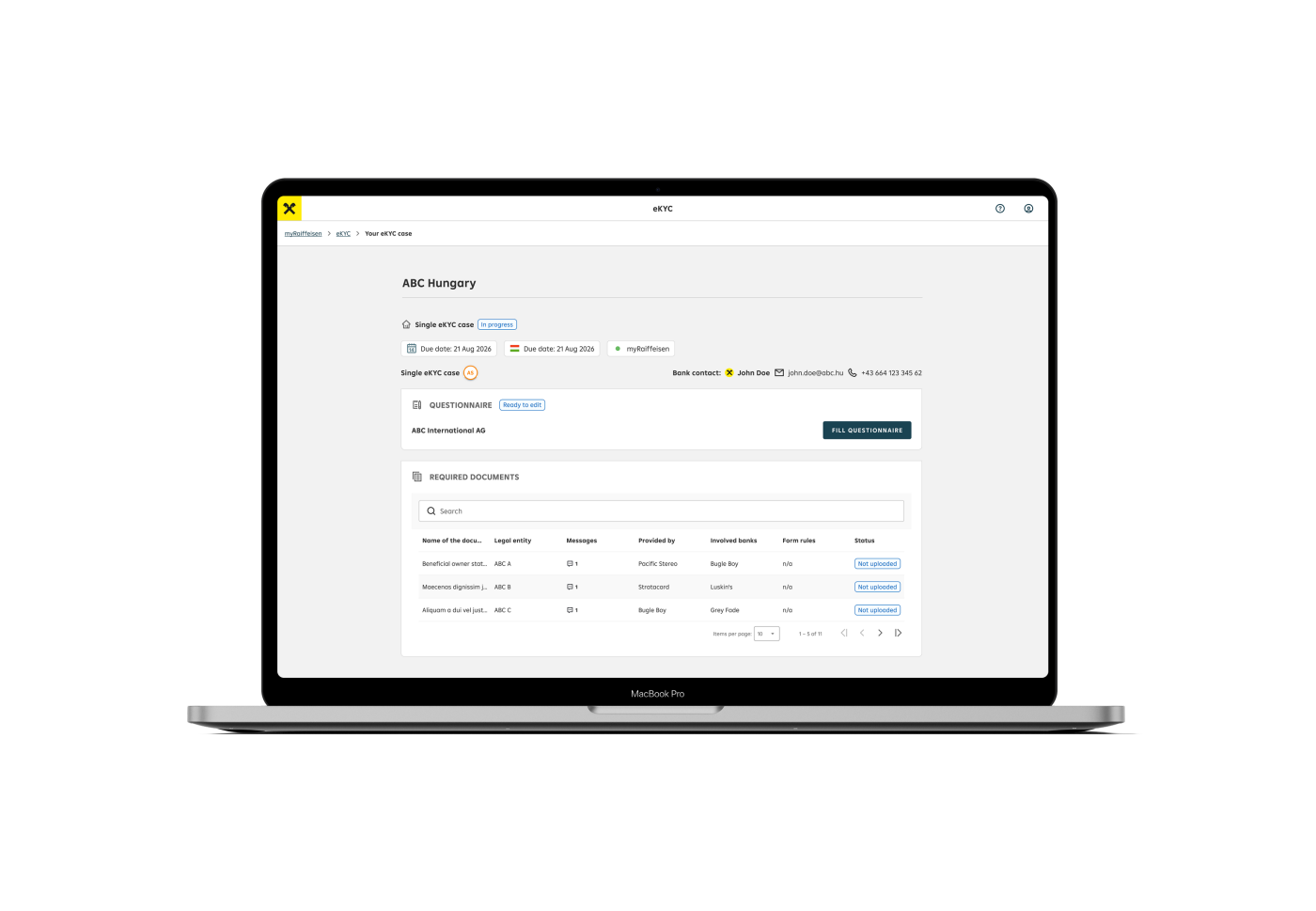

eKYC (Know Your Customer) – enables digital customer identification in the KYC process, facilitating secure data and document transmission.

ePIC (Payment Information Center) – digitizes the process of filling out payment forms, eliminating paper documents.

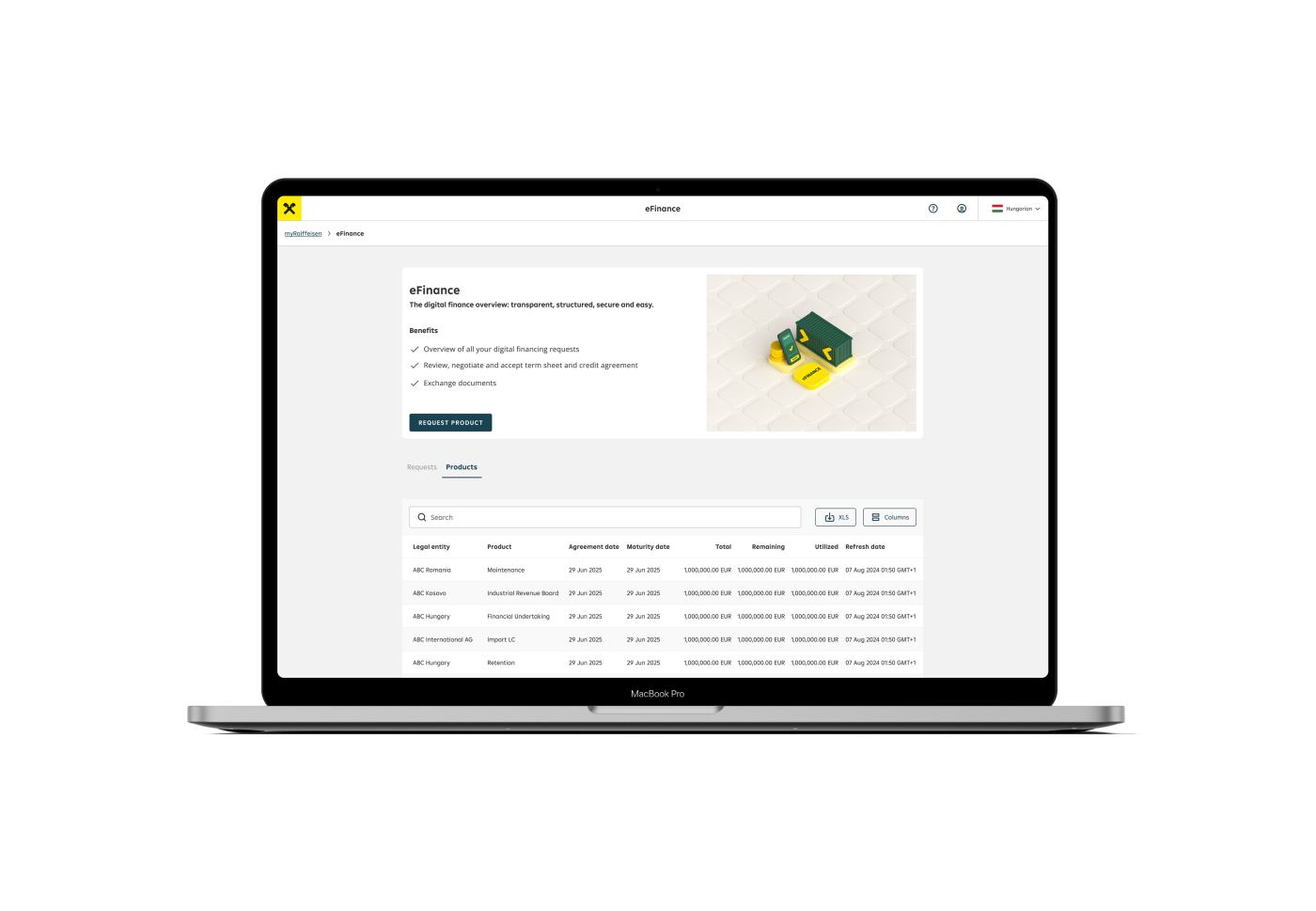

eFinance – allows for quick and fully digital financing, such as working capital loans or trade guarantees.

Group eAccount Opening – enables digital opening of corporate accounts in RBI Group banks in Austria and CEE countries, without the need for physical presence.

eTradeOn (and IC version) – allows for digital management of bank guarantees in foreign trade, with full transparency and real-time access to documents.

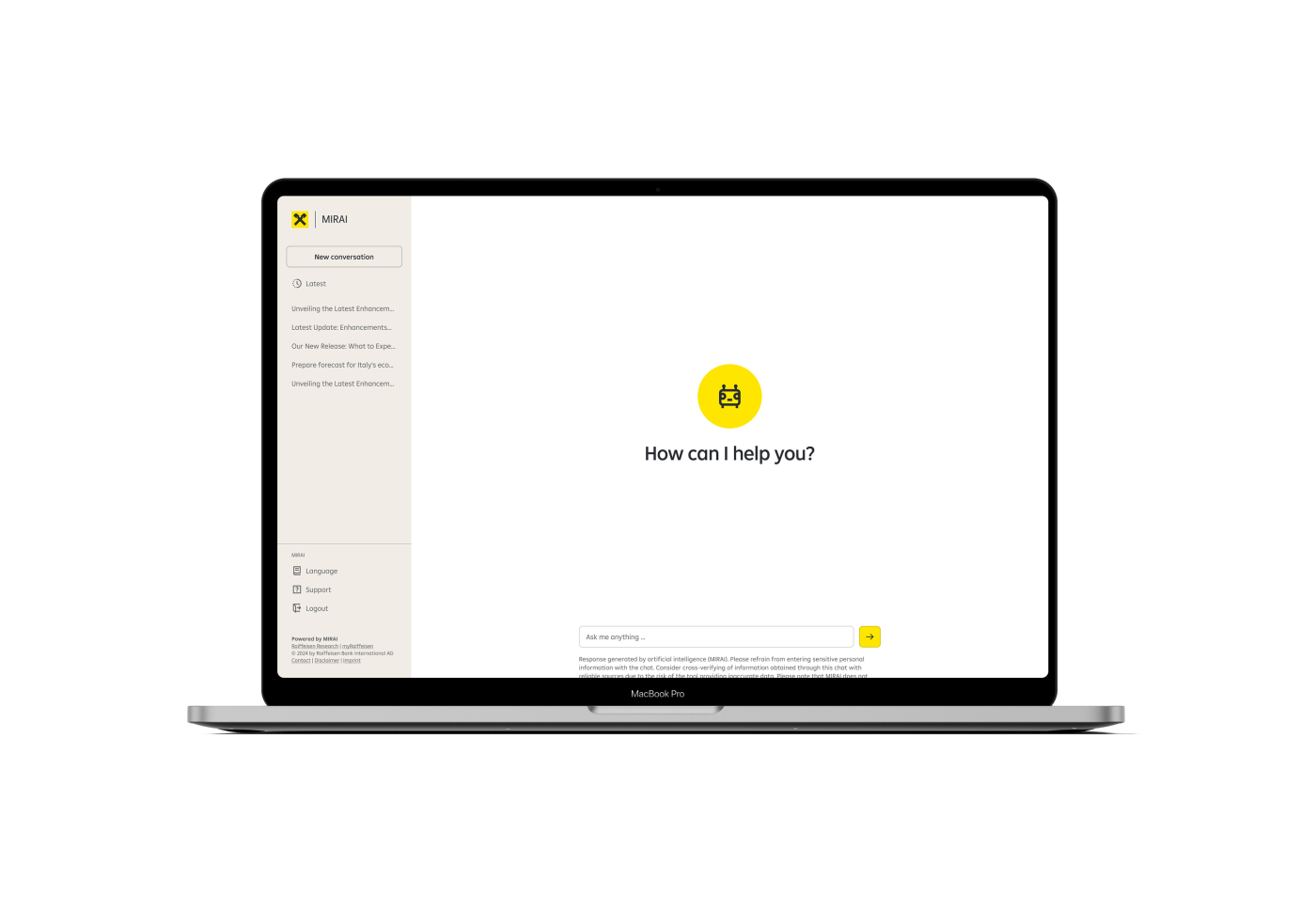

MIRAI – co-created with the Research team, an AI Assistant for both RBI employees and corporate clients, enabling the exploration of data and economic forecasts in a modern way.

eSAO – internally unifies the process of opening securities accounts, supporting task coordination on our bank's side.

eSignature – enables remote document signing using a qualified electronic signature (QES).

Available on the platform via SSO:

Digital Research Platform – offers financial and economic analyses with a focus on the CEE region, Austria, and the eurozone, supporting corporate clients' business decisions.

Payment Tracker – provides full transparency and real-time tracking of international payments within the RBI Group.

CMBS (Cash Management Billing Solution) – allows companies to monitor payment transaction costs across the group, with access to detailed online reports.

GIG (Global Investor Gate) – provides real-time access for institutional and corporate clients to securities accounts in Raiffeisen.

Striving to create solutions that genuinely support our clients, we focus primarily on listening to their needs and observing how they use the myRaiffeisen.com platform. Our commitment to developing digital services is based on analyzing user behavior, measuring KPIs, and statistical data, which help us better understand which areas need improvement – to meet customer expectations even more effectively.

Product Owner in the myRaiffeisen project

Find here some other example projects and products we currently work on.